Let's be honest, cash flow management isn't just about spreadsheets and numbers. It’s the real-world practice of keeping a close eye on the money coming in and going out of your business. It's what ensures you can actually pay your team, cover your rent, and keep the lights on—turning those "paper profits" into tangible stability and a runway for growth.

Why Cash Flow Is Your Business's Lifeline

Profit looks great on a P&L statement, but it doesn’t mean a thing if you can’t pay your bills. This simple, sometimes painful, truth is the heart of cash flow management.

It’s easy to get a rush from landing a huge client or seeing a profitable quarter. But that feeling evaporates fast when you realize the invoice won't be paid for another 60 days, and your biggest supplier needs their payment by Friday.

This is the classic (and often stressful) difference between being profitable and being cash-positive. Profit is an accounting metric; cash is the actual oxygen your business breathes. Without it, even the most promising company can suffocate. In fact, a shocking number of startups fail for this very reason—they simply run out of cash.

Understanding the Cash Flow Gap

That lag time between doing the work and getting the money in your bank account creates something called the cash flow gap.

Imagine a freelance designer wraps up a $5,000 project in May but, thanks to standard invoicing terms, doesn't actually get paid until July. In the meantime, they've still got to cover software subscriptions, internet bills, and their own salary. This is where the struggle starts for so many entrepreneurs.

This isn't a sign you have a broken business model—it’s a universal challenge. Research shows that roughly 51% of small businesses grapple with uneven cash flow, making it their third most common financial headache. This volatility makes it incredibly difficult to cover basic operating costs, let alone plan for the future. You can dig deeper into these numbers by checking out this research on small business cash flow.

Your goal isn't just to make money; it's to have money when you need it. Mastering cash flow means you stop reacting to financial surprises and start building a business resilient enough to handle them.

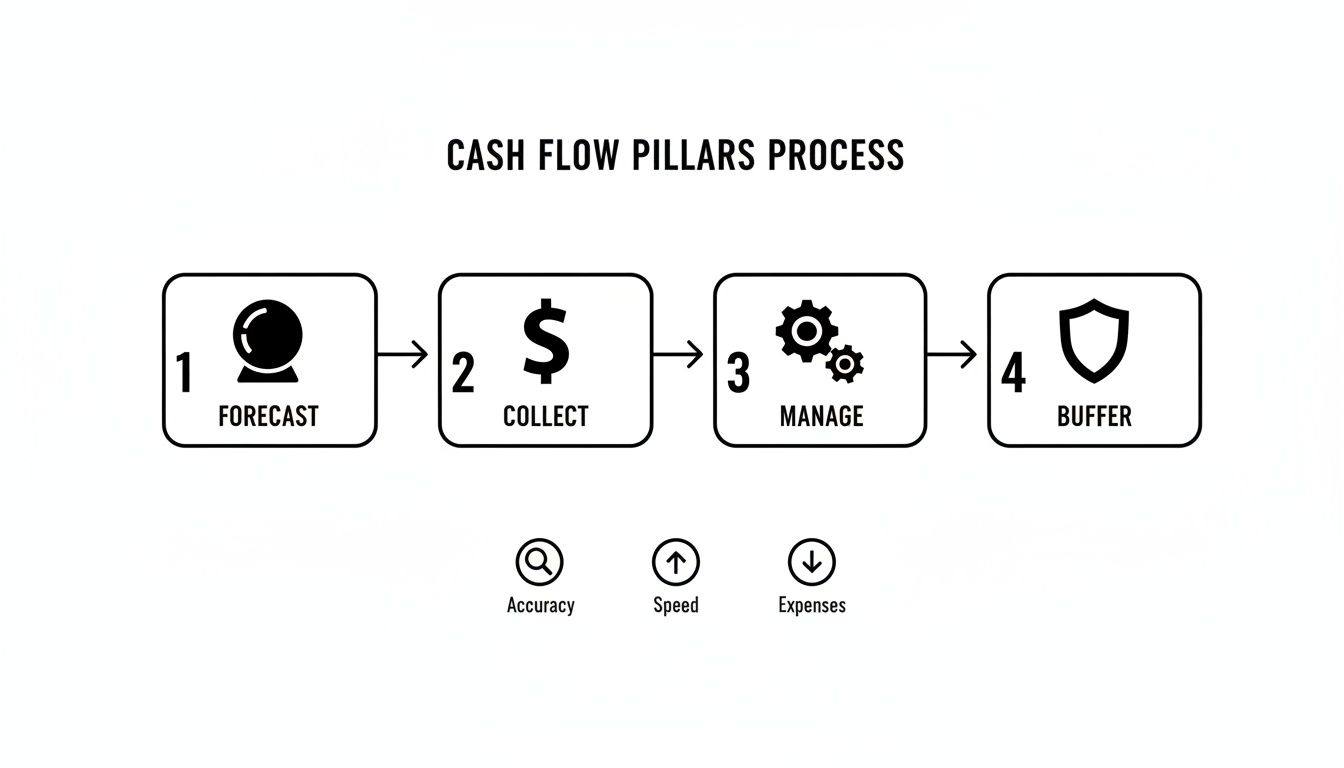

To get there, you need a clear, practical game plan. This entire guide is built around four core areas that will give you real control over your company's financial health.

Think of it like building a sturdy foundation. Each part supports the others, creating a structure that can weather any storm. Let's break down what those pillars look like.

The Four Pillars of Small Business Cash Flow Management

| Pillar | What It Means for Your Business | Key Action |

|---|---|---|

| Forecasting | Creating a reliable roadmap of your future cash position to anticipate shortfalls and opportunities. | Build and maintain a 13-week cash flow forecast. |

| Receivables | Speeding up the collection of money you're owed from customers and clients. | Implement strategies to get paid faster. |

| Payables | Intelligently managing your bills and expenses to hold onto cash longer. | Optimize your spending and payment schedules. |

| Buffers | Building a financial safety net to weather unexpected downturns or seize growth opportunities. | Establish a cash reserve and explore financing options. |

By focusing your efforts on these four areas, you're not just managing money—you're building a more durable, predictable, and ultimately more successful business. We'll dive into exactly how to master each one.

Build Your First Cash Flow Forecast

Trying to figure out your business’s financial future shouldn't feel like you're staring into a crystal ball. A cash flow forecast is a practical tool, not some mystical art. Think of it as your early-warning system—a clear, data-backed roadmap showing you exactly where your cash position is headed.

The whole point is to get a reliable picture of the cash you expect to come in and go out. When you can do that, you stop reacting to financial surprises and start making confident, forward-thinking decisions.

The Power of the 13-Week Forecast

So, why 13 weeks? It’s the perfect time frame. It neatly covers one business quarter, which is long enough to spot major upcoming expenses or sales cycles but short enough to stay relatively accurate and manageable.

Let's be clear: a 13-week forecast isn't about getting every single number right. It’s about making smart, educated guesses based on what you already know—your sales pipeline, recurring bills, and past performance. This simple habit helps you spot potential cash shortages weeks ahead of time, giving you plenty of room to breathe and take action.

Imagine a local café owner. While looking at her forecast, she sees a slow period in August lining up perfectly with a big payment for a new espresso machine. Because she spotted this five weeks out, she can run a "Summer BOGO" promotion to drum up sales or simply call the supplier to negotiate a different payment date. A stressful cash crunch is completely avoided.

This forecast is the foundation for everything else you do to manage your money, as you can see here.

As the chart shows, forecasting is the critical first step. It naturally leads into how you collect, manage, and build a buffer for your cash.

Estimating Your Cash Inflows

First up, map out all the cash you realistically expect to receive. This isn’t about just copying your sales goals; it’s about knowing when the money will actually hit your bank account.

Your cash coming in will likely fall into a few buckets:

- Sales Revenue: Dig into your historical sales data and current pipeline. If you run a retail shop, what are your average weekly sales? If you're a freelance designer, which invoices are due in the next few weeks?

- Project Payments: For service-based businesses, list out each client's payment schedule. Be honest with yourself here—if a certain client always pays 15 days late, build that delay into your forecast.

- Other Income: Don't forget other cash sources. This could be anything from a loan disbursement to an asset sale or a tax refund you know is coming.

My Two Cents: One of the biggest mistakes I see is over-the-top optimism. Build your forecast on realistic, even conservative, numbers. It's always better to be pleasantly surprised by extra cash than to be blindsided by a shortfall you didn't see coming.

Projecting Your Cash Outflows

Next, you need to list every single dollar you expect to spend. The good news is that this side of the equation is usually much more predictable than your income. Just pull up your recent bank and credit card statements to make sure you don't miss anything.

To keep things clear, I recommend splitting your outflows into two groups:

1. Fixed Costs (The Predictable Stuff)

These are the bills that are pretty much the same month after month.

- Rent or mortgage

- Salaries and payroll taxes

- Software subscriptions (your CRM, accounting tools, etc.)

- Insurance premiums

- Loan repayments

2. Variable Costs (The Moving Targets)

These expenses ebb and flow with your business activity.

- Inventory or raw materials

- Shipping and postage

- Payments to contractors or freelancers

- Marketing and ad spend

- Utilities (which can definitely jump around depending on the season)

A quick tip: Remember to budget for those less frequent but chunky outflows, like quarterly tax payments or annual insurance renewals. They are so easy to forget, but they can create a major headache if you’re not ready for them.

Many business owners kick this process off with a simple spreadsheet. While that works for a bit, manual tracking can quickly become a real chore. In fact, around 70% of small businesses still rely on spreadsheets, which are notorious for human error and a pain to keep updated. You can discover more insights about cash flow trends and see how dedicated software is changing the game.

Once you have your inflows and outflows plotted out week by week, the last part is just simple math. Start with your opening cash balance for the week, add your inflows, and then subtract your outflows. That gives you your closing cash balance for week one. This closing number then becomes the opening balance for week two, and on and on it goes. This rolling calculation is the beating heart of your forecast and a powerful tool for true cash flow management for small businesses.

Proven Strategies to Get Paid Faster

Let's be honest: waiting on unpaid invoices is one of the most frustrating parts of running a business. It feels like you’re trying to move forward with the emergency brake on. That gap between when you deliver great work and when the money actually lands in your account can be a real killer for small businesses.

The good news is, you're not powerless here. By being intentional about your invoicing and follow-up, you can shrink that gap and turn your accounts receivable into a reliable source of cash instead of a constant source of stress. It’s all about building a system that encourages clients to pay on time, every time.

Set Crystal-Clear Payment Terms from Day One

Fuzzy payment terms are a direct invitation for late payments. If your invoice just says "Due Upon Receipt," what does that even mean? To you, it means now. To your busy client, it might mean "whenever I get around to my next check run."

Don't leave any room for interpretation. Be explicit. Instead of a vague term like "Net 30," state the exact date: "Due by October 31, 2025." This simple switch creates a clear, firm deadline that’s impossible to ignore.

Better yet, don’t wait until the invoice to have this conversation. Your payment terms should be right there in your initial proposal and contract. When everyone agrees on the timeline before the work even starts, you avoid those awkward money talks down the road.

Nudge Clients with Smart Incentives and Automation

A little psychology goes a long way. People naturally respond to incentives and appreciate convenience, and you can absolutely use this to your advantage to speed up payments.

Here are a few tactics I’ve seen work wonders:

- Reward Early Payers: The classic "2/10, Net 30" approach still works. This simply means you offer a 2% discount if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days. For clients who watch their own cash flow, that little discount is a great motivator to put your invoice at the top of their pile.

- Introduce Late Fees: Be sure to state in your terms that overdue balances will incur a modest late fee, something like 1.5% per month. The goal isn't to make money off the fees—it's to create a consequence for paying late.

- Put Your Reminders on Autopilot: Who has time to manually chase every single invoice? Use your accounting software to automatically send out friendly reminders. A gentle nudge a few days before the due date, another on the day it's due, and a firmer one a week later can work magic. It ensures nothing gets forgotten.

Here’s a real-world example: I once worked with a B2B consultant whose income was all over the place. She ditched her project-based billing and moved to a retainer model. She started billing a flat fee on the 1st of every month for a set number of hours. Instantly, her income became predictable, making her cash flow forecasts incredibly accurate.

Master the Art of the Follow-Up

Even with the clearest terms, you’ll eventually need to chase down a payment. The way you handle this is everything. You need to be persistent without torching a good client relationship.

Don’t go in with guns blazing. Your first follow-up should always be a polite, gentle check-in. It’s entirely possible your invoice just got buried in a crowded inbox or sent to spam. A simple email is often all you need: "Hi [Client Name], just wanted to follow up on invoice #123 to make sure you received it. Please let me know if you have any questions!"

If email gets you nowhere, it's time to pick up the phone. It's much harder to ignore a friendly voice than another email. Keep your tone helpful and collaborative, not accusatory. Start the call with something like, "Hi, I'm just calling to make sure you got our invoice and see if there's anything I can do on my end to help get it processed." This positions you as a partner trying to solve a problem, not just a collector trying to get paid.

Tame Your Spending: How to Smartly Manage Bills and Expenses

We spend a lot of time chasing down payments and getting cash in the door, but managing the money flowing out is just as critical. Getting a handle on your payables—the bills you owe to suppliers, vendors, and for services—isn't about trying to get out of paying what you owe. Not at all.

It's about strategically timing those payments to keep more cash in your account for longer. That extra breathing room gives you incredible flexibility and a much-needed financial cushion. This is a delicate dance, though. You want to hold onto your cash, but you absolutely have to maintain strong, positive relationships with the suppliers who keep your business running. The secret is being proactive, professional, and strategic.

Don't Be Afraid to Negotiate Payment Terms

So many small business owners see terms like "Net 30" on an invoice and just accept it as gospel. But here's a little secret from the trenches: those terms are often just a starting point, not a hard-and-fast rule. If you've been a good customer with a solid payment history, you have more leverage than you think.

Let's say a key supplier has you on Net 30. A simple, friendly conversation could easily turn that into Net 45 or even Net 60. An extra 15 or 30 days might not sound like a world-changer, but it can be the difference between making payroll comfortably and sweating it out.

The trick is to have this conversation before you're in a cash crunch. Frame it as a partnership. You could try saying something like, "We absolutely love your products and we're planning to increase our orders this quarter. To help us manage the inventory on our end, would it be possible to extend our payment terms to Net 60?" It's a win-win.

Early Payment Discounts: A Blessing or a Curse?

You’ve probably seen this before: an offer of "2/10, Net 30." It means you can take a 2% discount if you pay within 10 days; otherwise, the full amount is due in 30 days. It sounds like a no-brainer, but it's a decision that requires a bit of math and a lot of honesty about your cash position.

Think about it. You're getting a 2% return for paying 20 days early. That might not sound like much, but when you annualize it, that's a return of over 36%! If your bank account is flush with cash, grabbing that discount is a brilliant financial move.

But—and this is a big but—if cash is tight, that discount has a steep hidden cost: your liquidity. Sending that cash out the door early might mean you can't cover another critical expense that pops up next week. This is exactly where your cash flow forecast becomes your best friend. Check your forecast. Will paying early create a problem down the road? If so, it's far wiser to hang onto your cash and pay the full amount on day 30.

A good rule of thumb: If you have more than three months of operating expenses in your cash reserve, taking advantage of early payment discounts is a smart strategy. If you have less, preserving your cash should almost always be your top priority.

Find and Plug the Leaks with a Regular Expense Audit

It’s the little things that get you. Those small, recurring expenses—software subscriptions, memberships, automatic payments—can bleed your cash flow dry without you even noticing. One of the simplest yet most effective things you can do is a regular expense audit to plug these tiny "cash leaks."

Set a reminder to do this once a quarter. Just sit down with your last 90 days of bank and credit card statements and go through them line by line. Ask yourself three simple questions for every charge:

- Is this absolutely essential? Are you actually using that project management tool you signed up for six months ago?

- Can I get a better deal? Maybe switching to an annual plan would save you money, or a competitor has a better offer.

- Is there a cheaper way? Can you downgrade to a lower subscription tier that still gives you everything you need?

You will be shocked by what you uncover. I worked with a small digital marketing agency that did this and found they were paying for three different SEO tools that all did basically the same thing. By consolidating to just one, they saved over $400 a month. That's an extra $5,000 a year in their pocket. This is what effective cash flow management for small businesses is all about.

Comparing Cash Outflow Management Strategies

Deciding whether to pay early, pay on time, or negotiate for later payments involves a trade-off. Here’s a quick breakdown of the different approaches to help you decide which is right for your situation.

| Strategy | Best For | Potential Benefit | Potential Risk |

|---|---|---|---|

| Early Payment for Discounts | Businesses with strong cash reserves and predictable income. | Reduces total expenses (e.g., 2% discount), boosting profit margins. | Can create a short-term cash crunch if not carefully planned. |

| Paying on the Due Date | Most businesses as a standard practice for predictable cash flow. | Maintains good supplier relationships and avoids late fees. | Misses out on potential savings from early payment discounts. |

| Negotiating Longer Terms | Growing businesses or those with long sales cycles (e.g., Net 60). | Maximizes cash on hand, improving liquidity and flexibility. | Can sometimes strain supplier relationships if not handled well. |

| Using Credit Cards | Deferring payment for short-term operational expenses. | Creates a 30-50 day interest-free float; can earn rewards. | High interest rates if the balance isn't paid in full each month. |

Ultimately, a mix of these strategies will likely serve you best. Use your cash flow forecast as your guide to make the right call at the right time.

Make Your Business Credit Card Work for You

Finally, don't sleep on the power of your business credit card. When you use it responsibly, it’s more than just a piece of plastic—it’s a powerful cash management tool.

Paying for expenses with a credit card is like getting a short, interest-free loan until your statement is due. This simple act can extend your payment cycle by an extra 20-30 days, which is incredibly helpful for aligning your spending with your revenue. For instance, you could buy inventory on your card, sell it to customers, and use the revenue from those sales to pay off the card balance before it's even due.

Plus, let's not forget the perks. Many cards offer significant cash-back rewards, which is basically like getting a small discount on everything you buy for your business. It all adds up.

Navigating Short-Term Financing and Cash Buffers

Let’s be real—even the most perfectly crafted forecast can’t predict everything. A key client might suddenly pay 30 days late, your main computer could give up the ghost, or an amazing growth opportunity could pop up that needs an immediate cash injection.

These moments are part of running a business. But they don't have to spiral into a full-blown crisis if you’ve got a financial safety net in place. Building that resilience comes down to two things: having a solid cash buffer and knowing how to smartly use short-term financing when you really need it.

First Things First: Build Your Cash Reserve

Think of a cash reserve as your business’s emergency fund. It’s simply a stash of money, tucked away in a separate savings account, that’s there to cover your essential operating expenses if revenue takes a dip. Honestly, having one is non-negotiable for staying in the game long-term.

So, what’s the magic number?

The gold standard is to have enough cash on hand to cover three to six months of essential operating expenses. We're talking about the must-pays: rent, payroll, utilities, software subscriptions—anything you need to keep the lights on.

I know that can sound like a huge, intimidating number, especially if you're just starting out. Don't get paralyzed by the final goal. Just start. Set up an automatic transfer to move a small percentage of every single payment you receive into that savings account.

Even if it’s just 5% or 10%, you’ll be surprised how quickly it starts to build a meaningful cushion. The most important thing is to get the habit started now.

Getting to Know Your Short-Term Financing Options

Sometimes, your cash buffer isn't quite enough, or you want to save it for a true worst-case scenario. This is where short-term financing can be a lifesaver for managing your cash flow. These tools aren't meant for taking on long-term debt; they’re designed specifically to help you bridge those temporary gaps.

Here’s a quick rundown of the most common players:

- Business Line of Credit: This is probably the most flexible option, acting like a credit card for your business. You get approved for a set limit, and you can draw from it whenever you need to. The best part? You only pay interest on what you actually use. It's fantastic for things like managing seasonal inventory or covering an unexpected project cost.

- Invoice Factoring: If you have clients who take forever to pay, this one’s for you. You essentially sell your unpaid invoices to a factoring company at a slight discount. They’ll give you a big chunk of the invoice value right away (often 80-90%) and the rest, minus their fee, once your client finally pays them.

- Merchant Cash Advance (MCA): This is geared toward businesses with a high volume of credit card sales, like a coffee shop or retail store. An MCA provider advances you a lump sum of cash. In return, they take a small, fixed percentage of your daily credit card sales until it's paid back. It's incredibly fast, but it can also be very expensive, so tread carefully with this one.

Choosing the Right Tool for the Job

The "best" option really depends on what you’re trying to solve. There’s no one-size-fits-all answer.

Let's imagine a small retail shop. The owner needs to buy a ton of holiday inventory in September but knows the big sales rush won't hit until November and December. This is a classic cash flow crunch.

A business line of credit is a perfect fit here. The owner can draw the funds to stock the shelves, then easily pay it back as the holiday revenue starts pouring in. This keeps them from wiping out their cash reserves right before their busiest season.

These strategies are more common than you might think. In the first quarter of 2025, a whopping 59% of small businesses leaned on a business line of credit to manage cash flow, while others had to resort to delaying their own pay. If you want to see how other businesses are navigating their finances, you can explore the latest small business trends. It just goes to show how important it is to have more than one play in your financial playbook.

Your Top Cash Flow Questions, Answered

Even when you feel like you have a solid grip on your finances, specific questions always seem to bubble up. It's totally normal to second-guess yourself or get tripped up by financial jargon.

Let’s tackle some of the most common head-scratchers I hear from business owners. This is your quick-reference guide to get you unstuck and back to making smart decisions.

How Often Should I Really Be Looking at My Cash Flow?

For most small businesses, checking in once a week is the magic number. It’s the perfect cadence to spot trouble on the horizon before it becomes a full-blown crisis, without making you feel like you’re chained to a spreadsheet. Think of it as a proactive weekly huddle with your money.

Now, if your business is all about high transaction volume—like a busy coffee shop or an online store during the holidays—you might want to do a quick daily check. On the flip side, the absolute bare minimum for anyone is a thorough review once a month. No exceptions.

What’s the Real Difference Between Cash Flow and Profit?

This one trips up so many people, but it’s probably the most crucial concept in business finance. I always tell people: profit is opinion, but cash is fact.

Your Profit & Loss (P&L) statement tells a story about your profitability over a period. It's a great story, but it includes things like accounts receivable (money you haven't actually received yet). It's an educated opinion of your financial health.

Your Cash Flow Statement, however, is the nitty-gritty reality of what’s happening in your bank account. It tracks the actual dollars coming in and going out. You can be profitable on paper but go under because a huge client pays their invoices 60 days late. For day-to-day survival, cash is everything.

You can post a record profit and still not have enough money to make payroll. It's not just about how much money you make; it’s about when that money lands in your account versus when it needs to go out.

I See a Cash Shortage Coming. What Do I Do Right Now?

Okay, first thing: take a deep breath. This is exactly why you have a forecast—to get a heads-up. Seeing it coming is half the battle. Now, let’s get into action mode.

Here’s a quick-start plan:

- Become the Squeaky Wheel: Get on the phone now about any and all overdue invoices. Be polite, but be firm. For invoices that aren't late yet, try offering a small discount (say, 2%) for immediate payment.

- Negotiate Your Bills: Scan your upcoming payables. Who can you call to ask for a week or two of grace? You'd be surprised how many suppliers are willing to work with you if you're proactive and honest. It’s all about preserving those relationships.

- Tap into Quick Financing: This is the time to look into short-term options. A business line of credit is a fantastic safety net, but you need to set it up before you're desperate.

- Run a Flash Sale: Is there a product or service you can discount for a quick revenue boost? A limited-time offer can often generate a much-needed injection of cash to get you through the rough patch.

Is It Worth Paying for Software to Help with This?

One hundred percent, yes. While a spreadsheet is a great place to start, dedicated accounting software is a total game-changer for cash flow management for small businesses.

Tools like QuickBooks or Xero sync directly with your bank accounts, which pulls in data automatically and gives you a real-time snapshot of your cash situation. This nearly eliminates the human error that creeps into spreadsheets and lets you generate powerful reports in seconds.

Honestly, it’s less about bookkeeping and more about buying back your time. You get to spend less time buried in numbers and more time actually thinking strategically about how to grow your business.

Ready to turn these insights into action and build your own thriving remote business? Remotepreneur provides the playbooks, founder stories, and step-by-step guides you need to move from idea to execution. Discover your path at Remotepreneur.co.

Article created using Outrank