Before you type a single word of your business plan, stop. The biggest mistake I see founders make is diving straight into writing without asking two simple questions: Who am I writing this for? and What do I want them to do?

Your business plan isn't just a document; it's a conversation. And a successful conversation starts with knowing your audience.

Know Your Audience and Goal Before You Start

Thinking about your reader first will save you a ton of rework later. A business plan is a tool, and the right tool for the job depends entirely on what you're trying to build—or who you're trying to convince.

The answer to "Who is this for?" changes everything—the tone, the focus, and especially the level of detail you'll need to include.

Tailor Your Plan to the Reader

A plan you write for a venture capitalist is going to look wildly different from one you'd show a bank loan officer.

A VC is looking for a home run. They want to see a massive, untapped market and a clear, believable path to a 10x return on their investment. They’ll jump straight to your scalability, your unique advantage, and your financial projections to see if the numbers support explosive growth.

On the other hand, a bank is all about minimizing risk. The loan officer's main concern is getting the bank's money back, with interest. They need to see a solid, stable business model, consistent positive cash flow, and a clear plan for making your loan payments on time. They care more about operational details and your ability to manage debt than a huge potential exit.

And if the plan is just for you and your team? It's your North Star—a roadmap to keep everyone aligned on the same goals, milestones, and priorities.

Key Takeaway: Your business plan needs to speak the language of its audience. For VCs, you sell the dream of massive growth. For bankers, you sell the reality of predictable, steady cash flow.

Decide Between a Lean or Traditional Plan

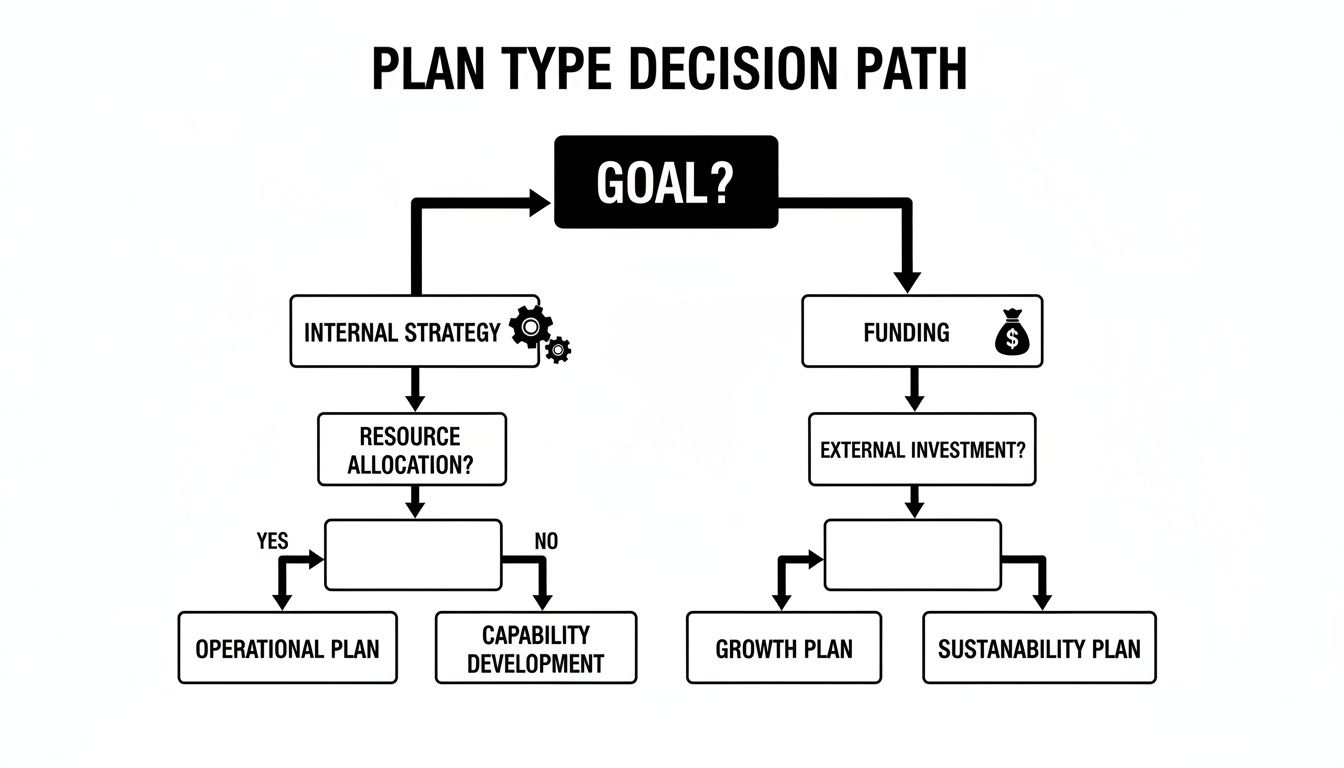

Once you know your audience, you can pick the right format. Not every situation calls for a 40-page deep dive.

-

The Lean, One-Page Plan: This is your go-to for internal strategy, hashing out ideas with a co-founder, or making a quick, informal pitch. It hits the high notes—your value proposition, who you serve, how you'll make money, and your core activities. The best part? It’s a living document you can update in minutes as you learn and pivot.

-

The Traditional, Comprehensive Plan: You'll need this when you're asking for serious money, whether from investors or a bank. This is the full-on, detailed version with in-depth market analysis, complete financial statements (income statement, cash flow, balance sheet), and a thorough breakdown of your operations. It proves you've done your homework and understand your business inside and out.

This little decision tree can help you figure out which path to take.

As you can see, choosing the right format from the get-go channels your energy where it matters most, ensuring your final plan actually achieves its purpose.

Crafting a Compelling Executive Summary

Let's be honest: your executive summary is probably the only part of your business plan that gets read every single time. Think of it less like a stuffy introduction and more like the trailer for a blockbuster movie. Its one and only job is to get a busy investor or loan officer so hooked they have to see the rest of the film.

This is your entire business—your passion, your data, your vision—distilled into one powerful page. It’s your elevator pitch on paper, and it needs to be sharp, compelling, and crystal clear from the get-go.

Hook Them From the First Line

You have about one sentence to grab their attention. Don't waste it.

Start with a bold, data-backed statement that frames the problem you're about to solve. Forget the vague mission statements and get right to the punch.

For example, a remote-first software company could lead with: “Companies burn an average of $12 billion a year on clunky project management tools their teams hate using. Our platform cuts that waste by 30% while boosting team engagement.”

See the difference? This approach immediately establishes a high-stakes problem and positions your company as the clear, quantifiable solution. It makes the reader lean in, wanting to know more.

Pro Tip: Always write the executive summary last. After you've wrestled with the nitty-gritty of your market analysis, financials, and operations plan, you'll finally have the clarity you need to summarize it all powerfully. Writing it first is like trying to write a book report without reading the book.

What Every Great Executive Summary Includes

To be effective, your summary needs to hit a few key points, answering the critical questions bouncing around in the reader's head. Structure it to flow logically from one pillar to the next.

- The Problem: Clearly spell out the pain point you’re solving. Who has this problem, and why does it matter so much?

- Your Solution: This is where you introduce your product or service. How, exactly, does it fix the problem you just laid out? What’s your secret sauce?

- Target Market: Give a quick snapshot of your ideal customer. Mention the size of the market to hint at the scale of the opportunity.

- Competitive Advantage: Why are you the one to solve this? Is it proprietary tech, a killer business model, an exclusive partnership, or something else entirely?

- Financial Highlights: You don’t need to drop a full spreadsheet here, but you do need to offer a tantalizing glimpse of your financial potential. Mention your projected revenue for year three, key profit margins, or how much you're looking to raise.

- The Ask: If you're seeking funding, be direct. State exactly how much you need and what specific milestones that capital will help you achieve, like launching a new feature or expanding into a new market.

Here’s how a fictional remote-first VA agency, AssistAway, might lay it out:

| Component | AssistAway Example |

|---|---|

| Problem | "Solo entrepreneurs waste 15+ hours a week on admin tasks that don't generate revenue, throttling their growth." |

| Solution | "AssistAway is a subscription platform connecting them with vetted, pre-trained virtual assistants, saving them an average of $25,000 a year." |

| Target Market | "We’re initially focused on the 1.2 million solo digital consultants across North America." |

| Advantage | "Our proprietary AI matching algorithm and continuous training model result in a 98% client-VA satisfaction rate, crushing industry standards." |

| Financials | "We're projecting $2.5M in ARR by Year 3 with a 40% net margin." |

| The Ask | "We are seeking $500,000 in seed funding to expand our AI technology and scale the marketing team." |

This isn't just a summary; it's a story. Each point builds on the last, creating a compelling narrative that proves your business is a sound—and exciting—investment.

Analyzing Your Market and Competitive Edge

A brilliant idea is a great start, but it's only half the battle. The other half is proving that real people will actually open their wallets for it. This is the part of your business plan where you swap exciting assumptions for cold, hard data. You’re showing potential investors that a hungry market is out there, just waiting for what you've built.

This is your chance to show you’ve done your homework. It’s about more than just a gut feeling; it’s about providing solid evidence that your business isn’t just a nice-to-have, but an absolute necessity for your customers.

The entrepreneurial spirit is booming—roughly 20% of adults around the world are involved in starting or running a new business. But the statistics can be sobering. Over two-thirds of startups don't make it to their 10th anniversary, and a staggering 21.5% fail within their first year.

What often separates the success stories from the cautionary tales? Planning. Businesses that are guided by a solid plan can literally double their chances of survival. It's worth diving into some more entrepreneurship statistics to really understand this landscape.

Defining Your Ideal Customer

Before you can size up a market, you have to know exactly who you're talking to. And no, "everyone" is not a target market. Getting laser-focused here makes every other part of your plan—especially marketing—infinitely easier and more effective.

The best way to do this is by creating an ideal customer profile (ICP), sometimes called a buyer persona. Think of it as a semi-fictional character, built from real data and research, who represents the person most likely to buy from you. Don't be vague; dig into the details.

Here’s what you should be thinking about:

- Demographics: What’s their age, income, job title, and location? For a remote-first business, "location" could mean specific time zones or even digital nomad hotspots.

- Psychographics: What do they truly care about? Think about their values, goals, and lifestyle. What podcasts do they listen to? What software do they already pay for?

- Pain Points: What specific, nagging problem keeps them up at night? How does this frustration impact their work or their life?

- Watering Holes: Where do they hang out online? Are they active in niche Slack communities, specific subreddits, or professional LinkedIn groups?

Real-World Example: Imagine a remote-first agency selling a productized video editing service. Their ICP might be: "Growth-stage SaaS founders, aged 30-45, who are active on Twitter and in private marketing communities. They know content is king but lack the in-house bandwidth to produce consistent video, which is slowing down their marketing pipeline."

See how specific that is? This level of detail proves you have a deep, empathetic understanding of your audience’s world. It instantly positions you as the perfect solution to their very specific problems.

Sizing Up the Market Opportunity

Okay, so you know who you're selling to. Now you have to prove there are enough of them out there to build a real business. This is where you calculate your market size, typically broken down into three logical tiers.

- Total Addressable Market (TAM): This is the big-picture number. It represents the total global demand for a product or service like yours.

- Serviceable Addressable Market (SAM): This is a more realistic slice of the TAM. It’s the portion of the market you can actually reach with your business model, considering any geographical or specialization limits.

- Serviceable Obtainable Market (SOM): This is your bullseye. It’s the portion of the SAM you can realistically capture in your first few years of operation.

Investors are savvy. They know you aren’t going to capture 100% of the total market overnight. Focusing on a realistic SOM shows them you have a grounded, actionable strategy for how to write a business plan that leads to real, achievable growth.

Charting the Competitive Landscape

Every business has competition. Period. Even if it's indirect (like a customer choosing to do nothing or use a clumsy spreadsheet), it's there. Ignoring your competitors is a massive red flag for anyone reading your plan.

This analysis isn't just about listing names. It's about dissecting their strengths and—more importantly—their weaknesses to find your unique opening in the market.

A competitive matrix is a fantastic tool for this. It helps you visualize exactly where you stand. Just list your top 3-5 competitors down the side and your key features or value propositions across the top.

Here’s a quick example for a hypothetical remote project management tool:

| Feature/Value Prop | Competitor A | Competitor B | Your Company |

|---|---|---|---|

| Pricing Model | Per User/Month | Freemium Tier | Flat Rate Per Project |

| Key Differentiator | Enterprise Integrations | Simplicity | AI-Powered Reporting |

| Target Audience | Large Corporations | Startups | Creative Agencies |

| Identified Weakness | Clunky UI | Limited Features | New to Market |

A simple chart like this instantly communicates your competitive edge. It shows you've surveyed the landscape and are deliberately positioning your business to fill a gap no one else is serving well. This is how you prove you’re not just another face in the crowd—you’re a serious contender with a clear plan to win.

What You're Selling and How You'll Make It Happen

Alright, you've painted the big picture of your market and where you fit in. Now it's time to get down to brass tacks. This is the section where you prove your grand idea isn't just smoke and mirrors—it's a real, tangible thing that you know how to build and deliver, day in and day out.

We'll break this down into two parts. First, we'll talk about your product or service, but not in the way you might think. Then, we’ll map out your operations plan, which for a remote company, is the secret sauce that makes everything work without a shared office.

It's Not a Feature, It's a Solution

One of the most common rookie mistakes I see when people are learning how to write a business plan is creating a laundry list of product features. Nobody—especially not an investor—is funding a list of features. They're funding a solution to a real, nagging problem.

Your job is to connect the dots. Don't just tell them what you offer; show them why it matters.

Instead of saying your graphic design subscription includes "unlimited revisions," frame it from the customer's perspective. Try something like this: "Our unlimited revision model gives founders the peace of mind to experiment with their branding without the fear of escalating project costs, ensuring they get the perfect design every time." See the difference? One is a feature, the other is a powerful benefit.

To really flesh this out, you’ll want to touch on a few key points:

- Product Lifecycle: Where are you right now? Is your product a rough prototype, in the middle of a manufacturing run, or already on the virtual shelves? If it’s software, are you in a closed beta or live for everyone to use?

- Intellectual Property: Do you have any patents pending, trademarks registered, or copyrights? Mentioning these shows you’ve built a "moat" around your business, making it harder for others to copy.

- The Road Ahead: Give them a sneak peek into your product roadmap. What's coming down the pike in the next 12-18 months? This shows you're not just thinking about today, but are building for the future.

My Two Cents: Always, always, always frame your product details through your customer's eyes. Ask yourself, "How does this make their life better, save them cash, or get them closer to their goals?" That’s the story that gets people to open their wallets.

Your Remote Operations Playbook

If your product is the star of the show, your operations plan is the entire backstage crew making sure the performance goes off without a hitch. It answers a very simple question: How does stuff actually get done around here? For a remote-first business, this is your chance to shine and show you've mastered the art of distributed work.

You need to demonstrate that you've built a well-oiled machine that's ready to scale.

Mapping Out Your Daily Grind

Think through the core, repeatable activities that keep your business running. How does a project kick off? How does your product get into the customer's hands? How do you make sure the quality is consistently high?

For a remote virtual assistant (VA) agency, the daily grind might look like this:

- Bringing a New Client Onboard: A slick, standardized workflow using a CRM and a project management tool to capture their needs, sign contracts, and assign the perfect VA.

- Delivering the Goods: Daily check-ins on Slack, weekly progress reports automatically generated from your project tool, and a clear process for handling any client issues that pop up.

- Keeping Quality High: A peer-review system where VAs check each other's major client work before it's sent out. This ensures top-notch quality across the board.

The Tech That Holds It All Together

For a remote company, your tech stack is your office. It’s your water cooler, your conference room, and your filing cabinet all rolled into one. You don't need to list every single app you use, but you absolutely should highlight the critical systems that keep your team connected and productive.

| Operational Area | Technology Example | What It Does For Us |

|---|---|---|

| Communication | Slack / Microsoft Teams | Our virtual hallway for real-time chat and daily huddles. |

| Project Management | Asana / Trello | Keeps everyone on the same page by tracking tasks and deadlines. |

| Client Relations | HubSpot / Salesforce | Manages our entire customer journey, from first contact to happy client. |

| File Management | Google Workspace / Dropbox | Our central, secure library for every important document. |

Laying out your tech stack this clearly does more than just list software. It proves you've intentionally designed a virtual workspace that’s both efficient and ready for growth. It shows that being remote isn’t a challenge for you—it’s a strategic advantage.

Weaving Your Marketing and Financial Story

Alright, this is where your business plan really comes to life. You’ve defined your market and mapped out your operations. Now it’s time to show potential investors or lenders exactly how you’re going to find customers and, crucially, make money.

A brilliant idea is a great start, but a well-reasoned plan for turning that idea into profit is what actually gets you funded.

We’ll start with your marketing strategy—how you’ll get noticed in a crowded world. Then, we’ll tackle the financial projections, the part that often feels the most intimidating. Don’t sweat it; I'll break it down into simple, manageable pieces.

Your Go-To-Market Strategy

Your marketing plan is much more than a list of ads you plan to run. It's the blueprint that connects your pricing, sales channels, and promotional efforts directly to that ideal customer you identified earlier.

-

Pricing Your Offer: How much are you going to charge, and why? Your pricing shouldn't be a random guess; it needs to reflect the genuine value you deliver. Maybe you’ll use a simple monthly subscription, a per-project flat fee, or even a value-based model where your fee is tied to the results you get for a client.

-

Sales Channels: Where will people actually buy from you? For a remote-first business, this is almost always digital. It could be your own website, a third-party marketplace like Etsy or the App Store, or direct outreach on professional networks like LinkedIn. The key is to be where your customers already are.

-

Promotional Tactics: This is how you'll spread the word. Instead of trying to do everything, get specific and focus on 2-3 core tactics you can execute flawlessly. Will you become a go-to resource through content marketing and a blog? Or will you build a passionate community in a Slack group or run hyper-targeted social media ads?

A sharp, focused marketing plan proves you aren't just crossing your fingers and hoping for customers. It shows you have a concrete, repeatable process for acquiring them, which builds tremendous confidence in your ability to generate revenue.

Making Sense of Your Financial Projections

Let's be honest: the numbers section is where most people's eyes glaze over. But your financial model is simply your business's story told with numbers. It translates all your hard work on marketing and operations into a concrete forecast. The two most important ingredients here? Honesty and realistic assumptions.

As we look ahead, financial planning is becoming more dynamic. In fact, 67% of businesses are now adopting automation, which can make forecasting more accurate. With a projected global economic growth of 3.0% for 2025 and 74% of U.S. business leaders expecting their revenues to increase, having data-driven projections is no longer a "nice-to-have."

Your plan should reflect this reality. Use solid assumptions to back up growth strategies, whether that’s introducing new products (53% of businesses plan this) or forming strategic partnerships (43%). To get a better feel for the current landscape, you can check out what business leaders are forecasting for 2025 and see how these trends might shape your own planning.

The Three Must-Have Financial Statements

For a rock-solid business plan, you’ll need to create three core financial documents. Think of them as different camera angles on your business, showing its profitability, cash situation, and overall financial health.

-

Sales Forecast: This is your starting point. You'll want to project your sales month-by-month for the first year, then annually for the next two to five years. Ground your numbers in your marketing plan. For example, if your strategy aims to land 10 new clients a month at a $500 price point, your first month's projected revenue is $5,000.

-

Expense Budget: Time to list everything you anticipate spending money on. This includes fixed costs—the predictable stuff like software subscriptions or a virtual mailbox—and variable costs, which fluctuate with your sales volume, like ad spend or contractor fees.

-

Cash Flow Statement: This one is a game-changer and might be the most critical document of the three. It tracks the actual cash coming in and going out of your business each month. It's entirely possible for a business to be "profitable" on paper but fail because it runs out of cash to pay its bills. This statement helps you see those shortfalls coming and manage your money like a pro.

Here's a simplified look at what a first-year sales forecast could look like, showing how revenue builds over time.

| Sample 12-Month Sales Forecast Breakdown | |||

|---|---|---|---|

| Month | Units Sold (Projected) | Price Per Unit | Monthly Revenue |

| Month 1 | 10 | $500 | $5,000 |

| Month 2 | 12 | $500 | $6,000 |

| Month 3 | 15 | $500 | $7,500 |

| Month 4 | 18 | $500 | $9,000 |

| Month 5 | 22 | $500 | $11,000 |

| Month 6 | 25 | $500 | $12,500 |

| Month 7 | 28 | $500 | $14,000 |

| Month 8 | 32 | $500 | $16,000 |

| Month 9 | 35 | $500 | $17,500 |

| Month 10 | 40 | $500 | $20,000 |

| Month 11 | 45 | $500 | $22,500 |

| Month 12 | 50 | $500 | $25,000 |

This example shows a steady growth trajectory, which you would then justify in your plan based on your marketing activities and market traction.

As you're learning how to write a business plan, always remember that the assumptions behind your numbers are just as important as the numbers themselves. Clearly explain why you think you can hit those sales targets and how you estimated your expenses. That transparency shows you’ve sweated the details and have a realistic financial outlook.

Alright, let's bring this section to life. It's time to talk about the final, most critical step: turning your business plan into cash.

Defining Your Funding Ask and Action Plan

You’ve done the hard work. The research, the projections, the strategy—it's all there. But a business plan isn't meant to collect dust on a digital shelf. Now it’s time to put that document to work.

This is where your plan transforms from a roadmap into a key that can unlock doors to capital. It's all about creating a clear, compelling "ask" that gets straight to the point. Whether you're walking into a meeting with a venture capitalist or a bank, clarity is your best friend.

Know Your Audience: Tailor the Pitch

Just like you wouldn't use the same sales pitch for two completely different customers, you can't use the same funding pitch for every investor. You’ve got to speak their language. The numbers a VC gets excited about are often worlds apart from what a bank loan officer needs to see for a good night's sleep.

-

Pitching to Venture Capitalists? They're hunting for home runs. Think big. Your conversation should revolve around your Total Addressable Market (TAM), customer acquisition cost (CAC), and lifetime value (LTV). The entire pitch needs to scream scalability and paint a clear picture of how they'll see a 10x return on their investment.

-

Talking to a Bank? They're all about managing risk. Your focus should be on stability and your ability to pay them back. Highlight your steady cash flow projections, your break-even analysis, and any collateral you can offer. You’re building a case for your reliability, proving you can make those loan payments month after month.

Understanding this difference is what separates a good plan from a plan that actually gets funded. You’re not just presenting an idea; you're demonstrating that you understand the financial world you’re stepping into.

This is especially true with VCs. Don't think you can just wing it with a slick slide deck. In 2023, nearly 7 out of 10 VCs said they passed on startups that didn't have a formal business plan. It's that fundamental. And as more businesses go digital, the tools to support them are booming—the business plan software market is expected to hit $8.5 billion by 2032. You can find more stats that prove why this groundwork is so vital in this roundup of key business plan statistics.

Make Your Ask Crystal Clear

When you ask for money, there should be zero room for confusion. Be direct, be specific, and tell them exactly what you need and what you're going to do with every last dollar.

Breaking down your funding request into specific categories shows you’ve done your homework. It proves you have a strategic plan for growth, not just a vague wish list.

Here’s a simple way to frame it:

| Allocation Category | Amount | What It Buys Us |

|---|---|---|

| Product Development | $150,000 | Hire two senior remote developers to finish our AI-matching algorithm. |

| Marketing & Sales | $75,000 | Launch targeted LinkedIn ad campaigns and sponsor three key industry newsletters. |

| Operational Headcount | $125,000 | Bring on a customer success manager to support our growing client base. |

| Total Ask | $350,000 | To get us to 500 active clients and $1M ARR within the next 18 months. |

Final Takeaway: At the end of the day, your business plan has one final job: securing the resources you need to bring your vision to life. When you tailor your ask and show investors exactly how their capital will fuel your growth, your plan becomes the most powerful sales tool you have.

Got Questions? We've Got Answers

So you've drafted your business plan. That’s a huge step, but let's be real—the questions don't stop there. Learning to write a business plan is one thing; knowing how to keep it a living, breathing guide for your company is another game entirely.

Let's dig into a few of the most common questions that pop up for founders.

How often should I actually look at this thing?

Your business plan isn't a "one-and-done" document you file away. Think of it as your company's GPS. You need to glance at it regularly to make sure you're still on the right road.

I always recommend a quarterly review. This is your chance to measure your actual progress against the milestones and financial forecasts you set. Are you hitting your numbers? If not, why?

A full-blown overhaul should happen at least annually, or whenever something big changes. This could be launching a major new service, seeing a competitor unexpectedly fold, or preparing to raise a new round of funding. These moments shift the ground beneath your feet, so your plan needs to shift, too.

Is a Plan for My Team Different Than One for Investors?

Absolutely. The core information might be the same, but the story you tell and what you emphasize are completely different.

-

Your Internal Plan: This is your team's playbook. It’s all about the nitty-gritty operational details, clear milestones, and who’s responsible for what. The language is straightforward because the goal is pure execution.

-

Your External Plan: This is your pitch. It’s built to sell the dream. Here, you’ll highlight the massive market opportunity, what makes you better than everyone else, and, most importantly, the potential return on investment. You're building confidence and excitement.

Think of it this way: one plan is about how you're going to build the car, and the other is about why it's going to be the fastest car on the track.

One of the quickest ways to lose credibility with an investor is to show them a "hockey stick" growth chart that isn't backed by solid, believable assumptions. They've seen it a thousand times, and they can spot unrealistic projections from a mile away. Keep your numbers grounded in reality.

Another classic mistake is being too vague. Don't just say you're entering a "large market." Use specific data. Don't just say you have "strong competitors." Name them and explain precisely how you'll win. A detailed, well-researched plan shows investors you're not just a dreamer—you're a doer who has done the homework.

Ready to turn your remote business idea into a reality? At Remotepreneur, we provide the playbooks, founder stories, and step-by-step guides to help you build from anywhere. Explore proven paths to remote success at https://www.remotepreneur.co.

Article created using Outrank