Building a real passive income stream is all about creating assets that make money for you, even when you’re not actively working. This means putting in the time or money upfront to build something—like a great affiliate blog, a helpful digital course, or a slick automated business—that eventually starts running on its own.

The big idea is to stop trading your hours for dollars and start owning the systems that generate the dollars instead.

Setting the Stage for Sustainable Income

Let's get one thing straight: this isn't about some "get rich quick" fantasy you see peddled on social media. Building legitimate passive income is a real business strategy, and it starts with a serious mental shift. You have to start thinking like an owner, not an employee.

Instead of just looking for a new business idea, the first step is actually taking a hard look at what you’re working with right now.

Assess Your Starting Point

Before you dive into a specific model, you need to know what you're bringing to the table. This is the part everyone skips, but it's honestly the most important. A quick, honest inventory of your resources will save you from chasing ideas that are a terrible fit for you.

Think about these three things:

- Your Skills: What are you genuinely good at? Don't just think about your job. Maybe you're a fantastic writer, a patient teacher, a wizard with graphic design, or just incredibly organized. These are the skills you can build a business on.

- Your Capital: How much cash can you actually afford to put into this? Some paths, like investing in dividend stocks, need a good chunk of money to start. Others, like writing an ebook or starting a niche blog, are more about your time commitment.

- Your Risk Tolerance: How much are you okay with losing? Putting money into the market feels very different from spending 50 hours creating an online course that might not sell. Be real with yourself about the level of risk you can stomach.

The point here isn’t to box you in. It's to help you focus. When you know your unique mix of skills, money, and risk appetite, you can immediately rule out the bad fits and zero in on the strategies where you have a built-in advantage.

To help you see how different models stack up against these factors, here's a quick comparison.

Passive Income Models at a Glance

This table gives you a bird's-eye view of the most popular passive income models. Use it to compare the upfront work, ongoing maintenance, and financial investment required for each, so you can find a path that aligns with your personal starting point.

| Income Model | Upfront Effort | Ongoing Effort | Capital Needed | Scalability |

|---|---|---|---|---|

| Affiliate Content | Medium-High | Low-Medium | Low | High |

| Online Courses | High | Low | Low-Medium | Very High |

| SaaS/Micro-SaaS | Very High | Medium | Medium-High | Very High |

| Automated Ecommerce | Medium | Low | Medium | High |

| Productized Services | Medium | Low | Low | Medium |

| Licensing/Royalties | Varies | Very Low | Varies | High |

Ultimately, the "best" model is the one that fits your life. A creator with a lot of time but little cash might lean toward affiliate content, while a developer with capital might aim for a Micro-SaaS.

Define Your Financial North Star

"I want more money" isn't a goal, it's a daydream. To actually get anywhere, you need a specific, measurable target to aim for. This clarity is what turns a vague wish into a real, actionable plan.

A solid financial goal sounds more like this: "Generate $1,000 per month in passive income within 18 months to cover my car payment and student loans." See the difference? It's specific, has a deadline, and is tied to a real-world purpose. This gives you the fuel to push through the tough spots and a benchmark to measure your success.

This isn't just a niche trend; it's a massive economic shift. The global gig economy was valued at a whopping $556.7 billion in 2024, showing how many people are already moving beyond traditional jobs. Data reveals that side hustlers pull in an average of $885 a month, and those who focus on scalable, passive models often earn even more. You can dive deeper into data on global economic trends to see just how big this movement is.

Setting your clear, personal goal is the first step to becoming a part of it.

Finding Your Ideal Passive Income Model

Alright, let's get down to the most important decision you'll make: choosing the right passive income model. This isn't just about picking something from a list; it's about finding the perfect match for your unique blend of skills, cash on hand, and genuine interests. Honestly, a model that genuinely excites you is the one you'll actually stick with long enough to see results.

Forget the high-level theory for a minute. We're going to dive into the nitty-gritty of several remote-friendly income streams. I'll break down what it really takes to get each one off the ground—from the initial investment and skills needed to what you can realistically expect to earn.

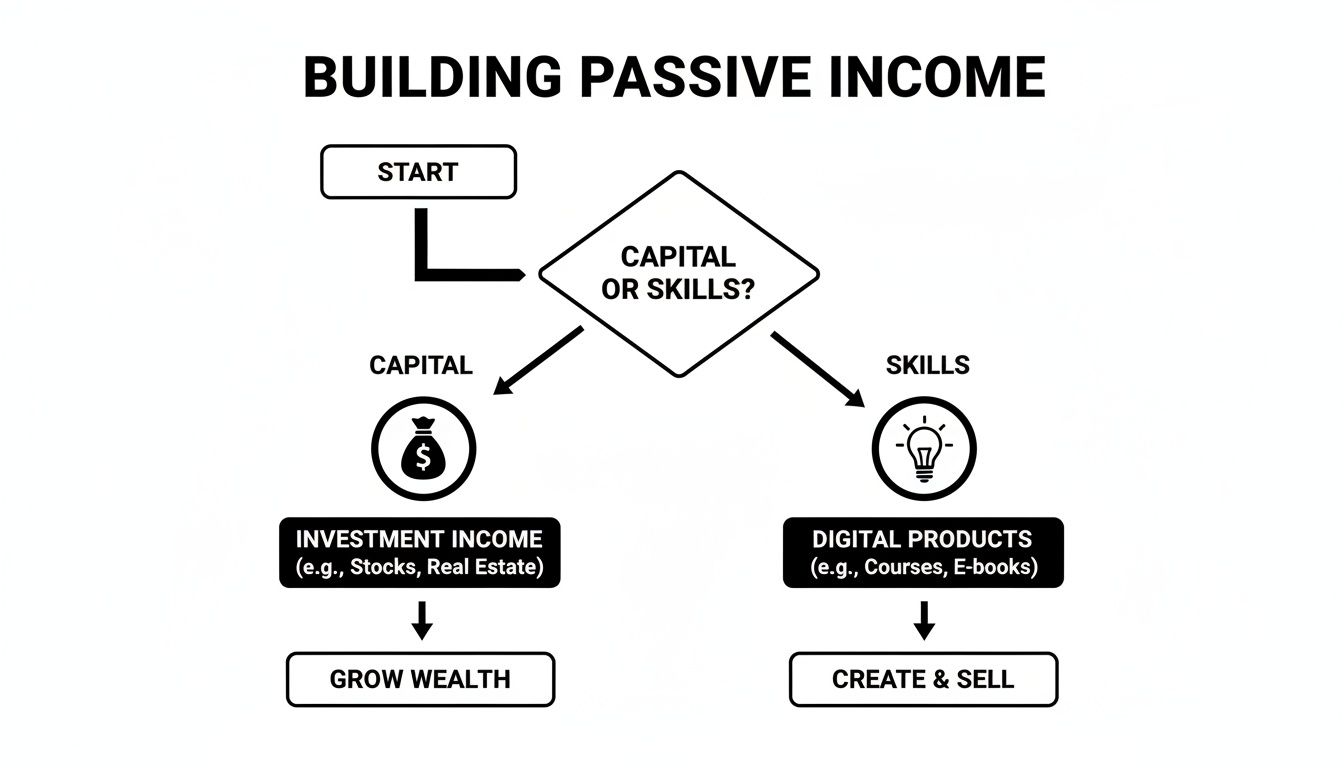

To kick things off, this flowchart visualizes the two main paths you can take. It all boils down to whether you're starting with more capital or a specific skill set.

As you can see, your starting point—money or expertise—simply points you toward different, but equally valid, strategies. There's no single "best" way, only the best way for you.

Skill-Based Income Models

If you're starting with more time and expertise than cash, skill-based models are your ticket to creating a valuable asset from scratch. These paths require a serious dose of upfront work, but the financial barrier to entry is incredibly low.

-

Affiliate Content Creation: This is all about building a niche website or a focused social media presence and earning commissions by recommending products you trust. Think of a coffee fanatic who starts a blog reviewing high-end espresso machines, linking to them on Amazon. The heavy lifting is all upfront—creating fantastic content and getting a handle on SEO—but once a post starts ranking, it can bring in cash for years with very little maintenance.

-

Digital Products and Online Courses: Got a skill people would gladly pay to learn? You can package that knowledge into an ebook, a bundle of design templates, or a full-blown video course. For instance, a graphic designer could sell a collection of professional Canva templates on a marketplace like Etsy. A seasoned project manager could create an online course on productivity frameworks. The beauty here is that once created, these products can be sold an infinite number of times.

The core idea behind skill-based models is simple: create something valuable once that can be sold over and over again. Your initial effort is the "active" work; the automated sales and delivery are what make it passive.

Capital-Based Income Models

On the flip side, if you have money to invest but not a ton of time to build something from the ground up, capital-based models let you put your money to work for you. These strategies are all about using your existing funds to buy or invest in income-generating assets.

Investments like dividend stocks and real estate are some of the most time-tested ways to generate passive income. Take Real Estate Investment Trusts (REITs), for example. The Dow Jones Equity All REIT Index delivered an impressive 11.3% return in 2023.

I'm particularly interested in REITs in "future-proof" sectors like data centers, especially with the massive demand being driven by AI. If you want to go deeper, you can explore more about building wealth through different investment streams to see how this fits into a bigger picture.

Hybrid Income Models

This is where things get really interesting. Some of the most powerful strategies are a blend of both skills and capital. These hybrid models often have higher barriers to entry, but they can also produce the most significant returns and create truly resilient businesses.

Here are a couple of my favorite examples:

-

Micro-SaaS (Software as a Service): This means building a small, hyper-focused software tool that solves one specific problem for a niche audience. It definitely requires coding skills (or the capital to hire a developer), but it creates a beautiful recurring revenue stream from monthly subscriptions. A perfect example is a simple browser extension that helps marketers track their social media mentions.

-

Automated Ecommerce: Instead of stuffing your garage with inventory, you can use a dropshipping or a third-party logistics (3PL) model. You put your marketing skills to work building a brand and driving sales on a platform like Shopify, while an automated system handles all the order fulfillment. Imagine a fitness influencer creating a line of branded workout gear, with every order shipped directly to the customer from the manufacturer.

In the end, the best model for you is one that not only fits your resources but also sparks a genuine fire in you. That enthusiasm is the fuel you'll need to power through the initial building phase and create a sustainable, long-term asset.

Validating Your Idea Before You Go All In

Let's be real. A brilliant idea for passive income is just a daydream until you have cold, hard proof that people will actually open their wallets for it. I've seen countless founders dive headfirst into building a full-blown product or website, only to waste months of their lives and thousands of dollars.

The smart play? Test your concept first. Think of validation as a cheap insurance policy against your own biases and assumptions. It’s how you find out if a real, painful-enough problem exists for your solution, and you can do it without breaking the bank. This step isn't just important; it's non-negotiable.

Low-Cost Ways to Test Market Demand

You absolutely do not need a finished product to see if your idea has legs. All you need is a way to gauge interest and see if people will take a small but meaningful action—like giving you an email address or, even better, pulling out their credit card.

Here are a few of my favorite, battle-tested tactics:

-

The Classic Landing Page Test: There's a reason this is the go-to method. Use a simple tool like Carrd, Leadpages, or Unbounce to whip up a single page. Describe the outcome of your future product, whether it's a course, SaaS tool, or ebook. Your only goal is to get people to sign up for a waitlist. If you can get 100 people to give you their email by sharing the page in a few relevant online communities, you're onto something promising.

-

Quick Social Media Polls: Platforms like X (formerly Twitter), LinkedIn, or even Instagram Stories are fantastic for getting a quick pulse check. But don't just ask, "Would you buy this?" That's a trap. Instead, frame your question around the problem. Ask something like, "What's the single biggest headache you face when it comes to [your topic]?" The answers are pure gold—they not only validate the problem's existence but also give you the exact words your future customers use to describe it.

-

The Ultimate Validation: Pre-Selling: This one is my personal favorite because it cuts through all the noise. You offer your product—a course, a set of templates, an ebook—at a steep discount before it's even finished. Be 100% transparent that it's a pre-sale and give a clear delivery date. If people are willing to pay for the promise of your solution, you have undeniable proof of market demand.

Remember, the point of validation isn't to make money right away; it's to gather data. You're looking for a strong signal that you've found a real problem for a specific group of people who are willing to pay to have it solved.

Build a Minimum Viable Asset

Once you have that green light from your validation tests, it’s time to build. But hold on—you’re not building the final, polished, all-the-bells-and-whistles version. Not yet.

You’re going to build a Minimum Viable Asset (MVA). An MVA is the absolute smallest, simplest version of your product that can still provide real value to your very first users.

The mindset here is "launch to learn," not "launch when perfect." Perfectionism is the silent killer of passive income projects. An MVA gets you out of your head and into the market, fast. This is where you start learning from real user behavior instead of just your own assumptions.

So, what does an MVA actually look like?

| Income Model | Example Minimum Viable Asset |

|---|---|

| Online Course | Just the first module (3-5 videos), sold at a deep "beta" discount. |

| Affiliate Blog | A focused niche site with just 10 high-quality, SEO-driven articles. |

| Micro-SaaS | A simple tool with only the one core feature that solves the main problem. |

| Digital Templates | A small starter pack of 5 templates instead of a massive bundle of 50. |

Building an MVA forces you to pinpoint the 20% of your idea that delivers 80% of the value. It gets you out of the endless planning phase and into the execution stage, where real momentum is built. You’ll start gathering testimonials, uncovering bugs, and discovering what features your audience truly wants—all while your asset is live and maybe even earning its first few dollars.

Alright, you've got your idea validated and your Minimum Viable Asset is out in the wild. Maybe it's even made its first few dollars. This is where the real fun starts. Now we shift gears from the active, hands-on building phase to the strategic work of automation. The goal is to turn your project into a well-oiled machine that earns for you, even when you’re not there.

Let's be clear: this isn't about setting it and completely forgetting it. It's about building an engine that runs itself, freeing you up from the daily grind. Instead of managing mundane tasks, you can focus on the big-picture growth. Think of it as hiring a team of digital employees who work around the clock—no coffee breaks needed.

Building Your Automation Stack

The secret to a genuinely passive income stream is choosing the right tools to handle the day-to-day operations. Your "automation stack" doesn't have to be complicated or break the bank. It just needs to be smart, connecting the different parts of your business so they run on their own.

Here's where to focus your efforts:

-

Marketing and Lead Nurture: Platforms like ConvertKit or MailerLite are perfect for this. You can set up automated email sequences that welcome new subscribers, deliver value, and eventually pitch your offer—all without you lifting a finger after the initial setup.

-

Content and Social Media: Don't get stuck on the content treadmill. With tools like Buffer or Later, you can schedule weeks or even months of social media posts in a single sitting. This keeps your brand visible and drives a consistent flow of traffic, even when you're focused on other things.

-

Connecting Your Apps: This is where the real magic happens. A tool like Zapier acts as the digital glue for all your apps, creating automated workflows that handle routine tasks for you. For example, you can create a "Zap" that automatically adds a new customer from your payment processor to a specific email list. It's that simple.

Zapier makes it incredibly easy to create these code-free workflows, connecting the dots between your favorite apps.

This screenshot shows just how powerful this is: a trigger in one app (like a new sale) sets off an automatic action in another (like sending a thank-you email). This one simple connection can save you hours of manual work.

Smart Strategies for Scaling

Automation keeps the lights on, but scaling is how you grow. True scalability means your revenue can climb without your workload climbing right along with it. Once your systems are humming along, you can focus on strategies that amplify your reach and impact.

One of the most powerful models for this is affiliate marketing. It's a massive industry, projected to hit $18.5 billion, and more than 80% of businesses are now using affiliate programs. Amazon's affiliate program alone dominates with a 46.21% market share. By building a high-quality niche website with solid SEO, you can create an asset that earns you passive commissions for years to come. Many creators have successfully scaled their affiliate income to over $10,000 a month after the initial grind. You can dive deeper into global investment opportunities and market trends to see where the market is heading.

Key Takeaway: Scaling isn't just about making more money. It’s about doing it efficiently by finding growth levers that don't demand more of your personal time.

Repurposing Content for Maximum Reach

If your business is built on content—like a blog, a course, or a YouTube channel—your best scaling strategy is repurposing. This is the art of taking one solid piece of content and spinning it into multiple formats to hit different audiences on their favorite platforms.

It’s a "create once, distribute forever" mindset. Here’s how it works in practice:

- Start with a Pillar Post: Write a comprehensive, long-form blog article on a core topic in your niche.

- Create a Video: Turn the key points from that article into a script for a YouTube video.

- Design an Infographic: Pull out the most interesting stats and data points and create a shareable infographic for Pinterest or Twitter.

- Make Short-Form Clips: Chop up your YouTube video into bite-sized, 30-60 second clips for TikTok, Instagram Reels, and YouTube Shorts.

- Write an Email Series: Break down the original blog post into a 5-day email mini-course to nurture your subscribers.

This approach lets a single burst of creative energy fuel your entire content engine for weeks, massively expanding your reach without you having to constantly reinvent the wheel.

Managing Your Finances Like a Business Owner

The moment that first dollar hits your account from your new project, something fundamental has to change. It's not a hobby anymore—you're officially a business owner. Adopting that mindset from day one is the single best thing you can do to protect yourself and build something that lasts.

This isn't about becoming a CPA overnight or drowning in complex spreadsheets. It's about building simple, professional habits that draw a clean line between your personal life and your business. This discipline is what separates a fun little side project from a real, wealth-generating asset.

Choose a Simple Business Structure

First up, you need a legal structure. I know, that sounds heavy, but for most people starting a passive income stream, it's pretty straightforward. Don't get stuck here; the goal is to just get started with something simple.

-

Sole Proprietorship: This is the default setting. If you start making money without filing any paperwork, you're a sole proprietor. It’s dead simple, but there's a huge catch: it offers zero liability protection. That means if your business gets into legal trouble, your personal assets—your car, your house—could be on the line.

-

Limited Liability Company (LLC): This is the next logical step up. An LLC creates a legal wall between you and the business. It shields your personal stuff from business debts and lawsuits, which is a massive relief. It costs a bit to register and involves some light paperwork, but the peace of mind is worth its weight in gold as you start to grow.

For most folks, starting as a sole proprietor while you're just testing the waters is perfectly fine. But as soon as you have consistent cash flow, upgrading to an LLC is a no-brainer.

Separate Your Finances Immediately

If you do only one thing from this section, make it this: open a separate bank account for your business. Right now. Mixing your business income with your personal spending money is a surefire way to create a bookkeeping disaster and a massive headache come tax time.

A dedicated business checking account gives you instant clarity. You can see exactly what's coming in and what's going out. That clarity is everything when it comes to making smart decisions, tracking your actual profit, and not wanting to pull your hair out in April.

Pro Tip: While you're at the bank, get a business credit card. Put all your business expenses on it—software subscriptions, ads, hosting fees, you name it. It automatically categorizes your spending for you and you can often rack up rewards to reinvest back into the business.

Track Everything and Know Your Deductions

With separate accounts, tracking your money becomes way easier. You don't need fancy software to begin with; a basic spreadsheet works just fine. The real key is just doing it consistently. Log every dollar that comes in and every dollar that goes out.

This simple habit really pays off when you discover the world of tax deductions. Every legitimate business expense lowers your taxable income, which means you keep more of the money you earn. For online ventures, common write-offs include:

- Software subscriptions (your email service, scheduler, etc.)

- Website hosting and domain name fees

- Courses or training you bought to improve your business skills

- Home office expenses (a percentage of your rent and utilities)

- Any money spent on marketing or advertising

By treating your passive income project like a real business from the get-go, you're building a rock-solid financial foundation. This is about more than just staying out of trouble with the IRS; it's about gaining the financial insight you need to scale your income with confidence.

Got Questions About Building Passive Income? Let's Clear Things Up.

Even with the best playbook in hand, it's completely normal to have questions. Let's be real—it’s one thing to read about these business models and another to actually start building one. So, let's dive into the most common questions that pop up and get you some straight answers.

How Much Money Do I Actually Need to Get Started?

This is probably the number one question I hear, and the honest answer is: it depends entirely on the path you choose. The myth that you need a huge pile of cash to get started is just that—a myth. It holds way too many people back.

You can genuinely get some of these income streams off the ground with next to nothing.

-

If you’re trading skills for cash: Think affiliate blogging, writing an ebook, or designing digital templates. Here, your biggest investment is your own time and brainpower. Your startup costs could be as low as a domain name and a year of basic web hosting—often less than $100.

-

If you're using money to make money: This is a different story. Models like dividend investing or buying rental properties obviously need a good chunk of capital to see any meaningful return. There’s just no getting around that.

The real key is to pick a model that fits where you are right now financially. Don't let a tight budget stop you from starting a skill-based project, and definitely don't jump into heavy investments with money you can't afford to lose.

How Long Until I Start Making Real Money?

Patience. That's the secret sauce most people forget. Building a real, sustainable passive income asset is a marathon, not a sprint. Anyone promising you a firehose of cash overnight is selling you a dream, not a business plan.

Here's a more realistic look at what to expect:

| Income Model | Realistic Time to First $1,000 |

|---|---|

| Affiliate Blog | 6-18 months. It takes time for Google to trust your site and for your articles to start climbing the search rankings. |

| Online Course | 3-9 months. This includes the time to test your idea, create all the content, and then actually market your launch. |

| Automated Ecommerce | 3-6 months. If you're relentless with testing, you can find a winning product and dial in your ads relatively quickly. |

| Dividend Stocks | Varies widely. This completely depends on how much you invest. It could take years to compound into a significant income stream. |

And remember, these are just estimates, not guarantees. Your own results will come down to your niche, how well you execute, and whether you show up consistently. The first phase is always active work; the "passive" part only kicks in once your systems are built and running smoothly.

What If I Don’t Have a Unique Skill or Idea?

Welcome to the club! This is classic imposter syndrome, and I promise, nearly every entrepreneur has felt this way. You don't need a world-changing, never-before-seen idea to build a successful business. In fact, it's often way smarter (and less risky) to enter a market where people are already spending money.

The truth is, you almost certainly have a skill someone would pay for.

- What do your friends and family ask you for help with? Budgeting tips? Organizing their closets? Planning the perfect party?

- Think about your hobbies. Are you an amazing gardener, a pro at home-brewing, or a wizard in a video game? Any genuine passion can be turned into a business.

- What problem have you solved for yourself? Maybe you figured out a genius meal-prepping system or learned how to fix a common car issue. That knowledge is valuable.

Your unique angle isn't about inventing a new category. It's about your personal perspective, your teaching style, or the specific audience you decide to help. "Public speaking" is a huge topic. But "public speaking for introverted software engineers"? Now that is a specific, valuable niche.

Is Passive Income Really Passive?

Yes and no. This is a super important distinction. The term "passive income" can be misleading because it makes it sound like you do nothing. A better way to think of it is decoupled income—meaning your earnings aren't directly tied to the hours you put in.

There are two distinct phases to this journey:

- The Active Building Phase: This is the grind. It's writing the blog posts, filming the course videos, or coding the software. This part is 100% active work.

- The Passive Maintenance Phase: Once your asset is built and your automations are humming along, your role changes. Your work becomes minimal—maybe a few hours a month to update content, check in on your systems, or respond to high-level questions. The income keeps flowing even when you're not at your desk.

So, while it takes a ton of effort to get the engine started, the whole point is to build something that eventually runs without you needing to be the one constantly pushing it.

Now that we've cleared up some of the big questions, let's look at a quick-reference guide for a few more common queries.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Which passive income model is the easiest to start? | Affiliate marketing or selling digital products (like templates or ebooks) generally have the lowest barriers to entry. Your main investment is time. |

| Do I need to be an expert to create a course? | You don't need to be the world's #1 expert. You just need to know more than your target audience and be able to guide them to a specific result. |

| Can I build more than one passive income stream at a time? | It's tempting, but focus on one until it's generating consistent income. Spreading yourself too thin is the fastest way to fail at all of them. |

| What's the biggest mistake people make? | Giving up too soon. Most people quit during the "active building phase" because they don't see immediate results. Consistency is everything. |

Hopefully, this table gives you some quick, clear answers to keep you moving forward with confidence.

Feeling fired up to start your own remote business? At Remotepreneur, we share the real stories and proven strategies behind successful location-independent businesses. Check out our founder case studies, practical guides, and tool recommendations to find a path that works for you. Start your journey today!