Stop chasing new customers for a minute.

Seriously. The real key to building a profitable, sustainable business isn't a never-ending hunt for new leads. It’s about focusing on the people who already know and trust you: your current customers.

This is where Customer Lifetime Value (CLV) comes in. It’s the total amount of money you can expect a customer to spend with you over their entire relationship with your brand. Think of it as the ultimate health metric for your business and the smartest way to grow.

Why CLV Is Your Secret Growth Engine

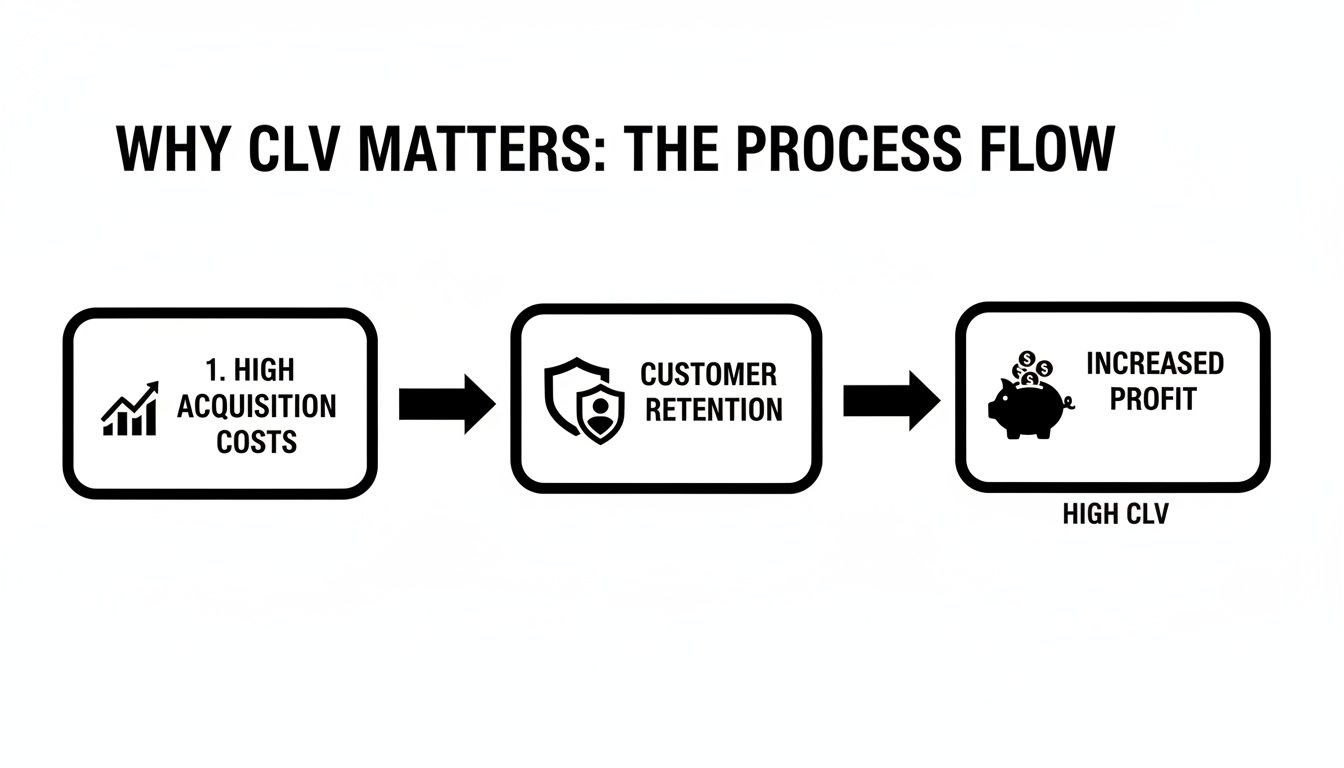

Running a remote-first business—whether you’re in SaaS, ecommerce, or consulting—means you’re constantly battling the rising cost of getting a new person to click "buy." It's an expensive game. This reality demands a shift in thinking, moving away from one-off sales and toward building lasting relationships.

Focusing on CLV isn't just a nice-to-have; it's a direct path to a much healthier bottom line.

When your CLV is high, it's more than just a number in a report. It's a reflection of genuine customer happiness, solid product value, and the kind of brand loyalty that competitors can't easily poach. It tells you people aren't just making a single purchase; they're weaving your product or service into their daily lives.

The Soaring Cost of a Single "Hello"

Let's talk numbers, because the financial argument for CLV is staggering. The cost to acquire a new customer has jumped by a whopping 222% in the last eight years. It can be up to 25 times more expensive to find someone new than to keep an existing customer happy.

Even a small improvement here pays huge dividends. A mere 5% increase in customer retention can boost your profitability by at least 25%—and in some industries, that number can shoot up to an incredible 95%. You can dig deeper into these customer lifetime value statistics to see the full impact.

The data paints a pretty clear picture. Dumping all your resources into acquisition while ignoring your current customer base is like trying to fill a bucket with a hole in it. You're just spinning your wheels.

Your most valuable customers are the ones you already have. They’ve already chosen you, trusted you with their money, and experienced your value firsthand. Nurturing that relationship is the highest-leverage activity you can focus on.

What a High CLV Truly Represents

When you nail your CLV strategy, it’s a sign that your whole business is clicking. It's proof of a few really good things happening all at once:

- Exceptional Product-Market Fit: You’re not just selling something; you're solving a real problem that keeps people coming back.

- Strong Brand Loyalty: Your customers feel connected to you for reasons beyond just the price tag, making them far less likely to jump ship.

- Effective Customer Support: Your team is turning problems into positive experiences, building trust with every interaction.

- Sustainable Revenue Streams: Your income becomes more predictable, which lets you plan for the future and invest in growth with confidence.

This guide is all about turning that theory into practice. We're going to walk through the real-world strategies you can put into action right now to build stronger customer bonds, inspire loyalty, and make CLV your most powerful engine for growth.

How to Figure Out Your Customer Lifetime Value

Before you can even think about boosting customer lifetime value (CLV), you have to know what you're working with. It's a classic case of "you can't improve what you don't measure." A lot of founders, especially in the remote space, get tripped up here, thinking they need a team of data scientists to get a number.

Good news: you don't. You can get a solid baseline for your CLV with some pretty straightforward math. Let’s walk through the formulas you need to get started. More importantly, we'll talk about why one single, company-wide number is just the beginning. The real insights pop when you start slicing and dicing this metric to actually guide your strategy.

This whole process is crucial because it directly connects the dots between today’s soaring customer acquisition costs and the profitability that comes from keeping people around.

As you can see, a solid retention game is your best weapon against high acquisition costs, paving a clear path to better profits.

Getting a Quick Snapshot With a Simple CLV Calculation

For most businesses, the easiest on-ramp is the historical CLV model. It just uses your past data to give you a reliable snapshot of what an average customer is worth. Think of it as a quick financial health check for your customer base.

To get this number, you'll need three key metrics. We'll break down what they mean and how to find them.

This table lays out the essential building blocks for calculating your CLV. Understanding these components is the first step to turning raw data into strategic action.

Key Metrics for Calculating Customer Lifetime Value

| Metric | What It Means | How to Calculate It |

|---|---|---|

| Average Purchase Value (APV) | The average amount a customer spends in one go. | Total Revenue (in a period) ÷ Number of Purchases (in same period) |

| Average Purchase Frequency Rate (APFR) | How often the average customer buys from you. | Total Number of Purchases ÷ Number of Unique Customers |

| Customer Lifespan (CL) | The average time a customer sticks with you before churning. | For subscriptions, a quick way is 1 ÷ Churn Rate. For ecommerce, it’s the average time between a customer's first and last order. |

Once you’ve got these three numbers plugged into your spreadsheet, you're ready for the main event.

The formula itself is super simple:

CLV = (Average Purchase Value x Average Purchase Frequency Rate) x Customer Lifespan

This gives you the total revenue you can reasonably expect from the average customer. It’s a powerful starting point that immediately shows you the long-term dollar value of your retention efforts.

Looking Ahead With Predictive CLV

The historical model is fantastic for getting a baseline, but it's a bit like driving while looking in the rearview mirror. A predictive model, on the other hand, gives you a forward-looking view. It uses current customer behaviors to forecast future value, which is a lifesaver for newer businesses without years of data to lean on.

Now, predictive models can get seriously complex and dip into machine learning, but you can create a simpler version that still packs a punch. It's all about looking at the early indicators of loyalty and engagement.

For example, you might look at:

- Product adoption rates if you run a SaaS.

- Engagement scores based on email opens or community posts.

- How recently someone purchased in your ecommerce store.

These clues help you spot your future VIPs early on. Think about it: a new freelance client who refers two other businesses in their first month has a wildly different potential CLV than one who just quietly pays their invoices on time.

Why You Absolutely Must Segment Your CLV

If you take only one thing away from this section, let it be this: a single, company-wide CLV is a vanity metric. It lumps your best customers in with your one-and-done buyers, completely hiding the insights you need to grow.

The real power is unlocked when you calculate CLV for different customer segments.

Imagine you sell online courses. Your overall CLV might be $500. That sounds okay, right? But once you start segmenting, the picture gets a lot clearer:

- Customers who found you on YouTube have a CLV of $850.

- Customers you acquired through paid ads have a CLV of $350.

- Students who bought the "Beginner's Bundle" have a CLV of $1,200.

This is where your strategy starts writing itself. You now have hard data telling you to pour more resources into your YouTube channel and to create more course bundles. By understanding which groups are driving the most long-term value, you turn CLV from a simple number into a roadmap for smart, sustainable growth.

Using Customer Segments to Create Personalized Experiences

So, you’ve calculated your Customer Lifetime Value. Great. Now, what do you do with it? That number is more than just a metric for a dashboard; it’s a compass pointing you toward real growth. The key to increasing customer lifetime value isn't just knowing the figure—it's using that insight to make every customer feel like you get them.

The days of blasting one-size-fits-all emails are long gone. Personalization is the name of the game now, and smart customer segmentation is how you win. By grouping customers based on what they actually do, you stop shouting one message into a crowd and start having thousands of individual conversations.

And this isn't just fluffy marketing talk. It has a huge impact on your revenue. Companies that really nail personalization bring in 40% more revenue than their slower-moving competitors. Think about it: 60% of consumers say they’re likely to become repeat buyers after a personalized experience. Find out more about these powerful customer lifetime value statistics on tipsonblogging.com.

Segmentation Strategies for Different Business Models

Effective segmentation goes way beyond basic demographics like age or location. You need to get under the hood and group people based on how they interact with your business. What that looks like will vary, but the mission is always the same: understand what makes them tick.

Let’s break it down with some real-world examples for remote-first businesses:

- Ecommerce Store: Forget just segmenting by country. Use RFM analysis (Recency, Frequency, Monetary value). This model instantly shows you who your best customers are—the ones you should be treating like VIPs.

- SaaS Business: Group your users by which features they’re using. Who are your power users? More importantly, who’s at risk of churning because they haven't touched that one killer feature yet?

- Freelancer or Agency: Segment your clients by industry or the type of project you did for them. If you build websites for both local bakeries and tech startups, your follow-up conversations should sound completely different.

This approach lets you craft offers, content, and support that actually land because they’re relevant to each person's unique journey with you.

Putting Your Segments into Action

Okay, so you’ve got your segments defined. That’s the first half of the job. The real magic happens when you use those groups to launch targeted campaigns that get results. You aren’t just labeling people; you're creating a playbook to make their experience better and, by extension, boost their value over time.

Here’s how this might look in practice:

-

Re-Engaging At-Risk SaaS Users: For that "Low Feature Adoption" segment, why not set up an automated email sequence? Instead of a pushy sales pitch, send them a few friendly tutorials showing them how to use the exact features they’re missing out on. Frame it around their success, not yours.

-

Rewarding High-Value Ecommerce Shoppers: Your "High RFM Score" folks are your rockstars. Don't send them the same 10% off coupon you send everyone else. Give them early access to a new product drop, throw a surprise freebie into their next order, or invite them to a private Slack community.

-

Cross-Selling to Agency Clients: You have a segment of clients who just wrapped up a big branding project. Perfect. This is your "Prime for a Retainer" group. A targeted offer for a monthly social media management package will feel like a natural next step for them, not a random upsell.

The goal of segmentation isn't to put people in boxes. It’s to understand them well enough to break down the walls of generic marketing and build a genuine, one-to-one connection.

Each of these actions feels personal and perfectly timed. You’re strengthening the relationship and making it a no-brainer for them to stick around and invest more with you. By focusing on what specific groups of customers need, your marketing stops being an interruption and starts being a welcome service. That, right there, is the foundation for growing CLV across the board.

Actionable Tactics for Building Lasting Customer Loyalty

Loyalty isn't something you can buy; you have to earn it, one positive interaction at a time. The tactics for building it are the real foundation for increasing customer lifetime value. It all comes down to creating an experience so valuable and seamless that customers wouldn't even think about going elsewhere.

This isn’t about big, expensive gestures. It's about consistently delivering on your promises and showing up for your customers in ways that actually matter to them. From the moment they sign up to the day they need a hand, every single touchpoint is a chance to build a stronger bond.

Nail the Onboarding Experience

A customer's first few interactions with your business set the tone for the entire relationship. A clunky, confusing, or just plain underwhelming onboarding process is a fast track to churn. A great one, on the other hand, makes people feel smart, confident, and instantly sure they made the right choice.

The goal here is simple: get them to their first "aha!" moment as quickly as you possibly can. This is that magic point where they truly get the value your product or service brings to their life.

- SaaS Business: Don't just dump users into a dashboard and hope for the best. Use interactive walkthroughs, checklists, and a welcome email series to guide them through setting up their first critical feature.

- Course Creator: Your welcome module should do more than just say hello. It needs to give them an immediate small win, like completing a simple worksheet or getting a warm welcome in the private community.

- Agency: The kickoff call is your onboarding. A crystal-clear agenda, a defined project plan, and an introduction to their main point of contact build trust right out of the gate.

Build a Proactive Customer Support System

Great customer support isn't just about reacting to problems—it’s about getting ahead of them. A proactive system anticipates what your customers might need and offers help before they even have to ask. This approach turns support from a cost center into a powerful retention engine.

It proves you’re paying attention and that you genuinely care about their success. Think about creating a comprehensive knowledge base, offering in-app tooltips for tricky features, or sending a friendly check-in email if you notice a user's activity has dropped off.

Waiting for a customer to complain is a losing strategy. The most loyal customers are the ones who feel supported throughout their entire journey, not just when something breaks.

Create Content That Helps Customers Win

Your content shouldn't just be for attracting new leads. A huge—and often overlooked—part of your content strategy should be dedicated to helping your existing customers get more value from what they've already bought from you.

This kind of content reinforces their decision to choose you in the first place and helps turn them into power users.

Content ideas for customer success:

- Advanced Tutorials: Go deep. Create blog posts or videos that really explore specific features or advanced use cases.

- Case Studies: Show off how other customers are getting amazing results. This gives your current users both inspiration and a clear path to follow.

- Best Practice Guides: Help them optimize their workflow. For a freelancer, this could be a guide on how to pitch clients using the templates you provided them.

Rethink Your Loyalty Program

Let’s be honest, traditional "buy 10, get one free" loyalty programs can feel a bit transactional and dated. To build real loyalty, you need to think beyond simple discounts. Focus on rewards that offer status, community, and exclusive access.

For an e-commerce store, this could be early access to new collections. For a course creator, it might be an invitation to a private monthly Q&A session. Perks like these make your best customers feel like insiders, strengthening their emotional connection to your brand.

Use Feedback as a Roadmap

Every single piece of customer feedback is a gift. It's a direct line into what you're doing right and where you need to get better. Don't just collect feedback with surveys and let it die in a spreadsheet. You have to act on it, and just as importantly, close the loop.

When a customer makes a suggestion and you actually implement it, let them know. A simple email saying, "Hey, remember that feature you asked for? We just built it," is one of the most powerful loyalty-building messages you can ever send.

It shows you're not just listening—you're a partner in their success. This consistent, customer-centric approach is vital, especially when you look at the data. Firms with strong omnichannel strategies retain a whopping 89% of customers, compared to just 33% for those with weak ones. To see how omnichannel experiences tie into retention, you can explore a full breakdown of CLV statistics.

Boosting Revenue with Smart Monetization Strategies

Once you’ve earned a customer's trust and they're happy with what you offer, the relationship doesn't have to end there. This is your chance to go deeper. We're not talking about squeezing every last dime out of them, but about finding genuinely helpful ways to deliver more value. When you do that, more revenue naturally follows.

Getting this right is a huge piece of the puzzle for increasing customer lifetime value. It creates a win-win: your customers get to solve bigger problems, and your business gets stronger and more predictable.

The real secret is timing. You have to present the right offer at the perfect moment. When a customer is already engaged and seeing results, a well-timed upsell or cross-sell feels less like a sales pitch and more like a great suggestion from a trusted advisor.

The Art of the Upsell and Cross-Sell

Let's talk about two of the most direct ways to grow revenue from the customers you already have: upselling and cross-selling. Think of upselling as encouraging customers to buy a better, more premium version of what they're already considering. Cross-selling, on the other hand, is all about offering a related or complementary product that makes their original purchase even better.

Don't underestimate how powerful this is. According to sales leaders, a staggering 31% of revenue comes directly from these two tactics.

These strategies really sing when they feel like a natural next step for your customer.

- Running a SaaS business? An upsell could be a friendly nudge to upgrade to a higher-tier plan once a user starts hitting their usage limits. A cross-sell? Maybe you offer an add-on for advanced analytics to a customer who’s constantly in your reporting dashboard.

- Have an ecommerce store? When someone adds a camera to their cart, an upsell would be showing them a slightly better model with features you know they'll love. A cross-sell is suggesting a must-have accessory, like a compatible lens, a tripod, or a camera bag right on the checkout page.

- Working as a freelance designer? After you knock a logo design out of the park, an upsell might be a full branding package. A cross-sell could be a monthly retainer to handle all their social media graphics.

Here’s a pro tip: Frame every upsell and cross-sell around the customer's success. Instead of saying, "Buy our premium plan," try something like, "Unlock advanced features to get results faster." This small shift in language changes everything—it’s about their gain, not your sale.

Creating Predictable Revenue with Tiers and Subscriptions

Beyond these one-off boosts, you can create some serious stability by building recurring revenue models into your business. Tiered pricing and subscriptions are absolute game-changers for creating predictable income and watching your CLV soar.

A tiered model is brilliant because it lets customers pick a plan that fits their needs and budget right now, while giving them a clear path to upgrade as they grow. This is the bread and butter of most SaaS companies, but you can adapt it to almost any business. An agency, for example, could offer tiered monthly retainers—say, basic, pro, and enterprise—each with a different scope of work and level of support.

Subscriptions, meanwhile, turn one-time buyers into long-term partners. We're seeing this model explode in ecommerce with "subscribe and save" options for things people use regularly. A coffee brand, for instance, can dramatically boost its CLV by offering a monthly bean delivery service. A single sale just turned into a year's worth of predictable cash flow.

To see how these play out, it helps to compare them side-by-side across a few different remote businesses.

Upsell vs. Cross-Sell Strategies for Different Business Models

Here’s a quick look at how upselling and cross-selling work in practice for SaaS, Ecommerce, and Agency models.

| Business Model | Effective Upsell Example | Effective Cross-Sell Example |

|---|---|---|

| SaaS | Moving a user from a "Basic" plan to a "Pro" plan with more features and higher limits. | Offering a separate "AI Assistant" add-on product to existing customers. |

| Ecommerce | Suggesting a premium, organic cotton version of a t-shirt the customer is viewing. | Recommending matching shorts and socks when a customer adds a running shirt to their cart. |

| Agency | Upgrading a one-off website audit to a full-scale SEO implementation project. | Selling a monthly content marketing package to a client you just built a website for. |

As you can see, each strategy is designed to meet the customer right where they are and offer a logical next step.

When you thoughtfully weave these monetization tactics into your customer journey, you’re doing more than just bumping up revenue. You're building a more valuable, more indispensable service that your customers will want to stick with for the long haul. That proactive approach to adding value is what really drives sustainable CLV growth.

Putting Your CLV Growth Plan Into Action

Alright, we've covered a lot of ground. But theory is one thing—real growth comes from actually doing the work. This is where the rubber meets the road. I'm going to give you a practical roadmap to turn these ideas into real dollars in your bank account.

The secret? Don't try to boil the ocean. If you try to do everything at once, you'll get overwhelmed and do nothing. The goal is to start small, build momentum, and let your data show you where to go next. We're aiming for a few quick wins to prove this works and build from there.

This approach turns increasing customer lifetime value from a daunting project into a series of manageable steps.

Your First Three Moves

Ready to get your hands dirty? Here’s a simple checklist to get the ball rolling this week. Think of it as your launchpad.

-

Nail Down Your Basic CLV: Forget about fancy predictive models for now. Just pull your numbers and calculate your historical CLV using the formula we walked through earlier. Getting that first baseline number is a massive win in itself.

-

Identify Your Top 3 Segments: Dive into your customer data. Who are your VIPs—the ones with high RFM scores who buy often and spend a lot? Who are your newbies, still in their first 30 days? And who’s at risk of churning—maybe they haven't bought anything in 90 days? Just give these groups a name and start a simple list.

-

Kick Off One Targeted Campaign: Pick one of those segments (your VIPs are always a great bet) and do something just for them. It doesn’t have to be complicated. An email offering early access to a new product or even a personal thank-you note with a small, unexpected gift can work wonders.

The most effective CLV strategies don't begin with a complete overhaul. They start with a single, focused experiment designed to make one group of customers feel seen and valued.

Finally, let's talk tools. You probably already have what you need. Your current CRM and email marketing platform, whether it's Klaviyo, Mailchimp, or something else, are more than capable of handling basic segmentation and targeted campaigns.

Don't get sidetracked by shiny new software. Use what you have, measure the results of that first small campaign, and let that success fuel your next step.

Common Questions About Increasing Customer Lifetime Value

Diving into CLV for the first time usually sparks a few questions. I see them pop up all the time with founders. Let's walk through some of the most common ones so you can move forward with a clear head and a solid retention strategy.

What Is a Good Customer Lifetime Value?

This is the big one, but there's no single magic number. What's "good" really comes down to your industry and, more importantly, how much you're spending to get customers in the door—your Customer Acquisition Cost (CAC).

A solid rule of thumb to aim for is a CLV to CAC ratio of 3:1.

Basically, for every dollar you spend to land a new customer, you want to see at least three dollars in revenue from them over their entire relationship with you. If you’re seeing a 1:1 ratio, you're just breaking even on your marketing spend. Anything lower, and you're likely overspending on acquisition and need to seriously look at your retention game.

How Often Should I Calculate CLV?

For most remote-first businesses, running the numbers quarterly or twice a year hits the sweet spot. This gives you enough data to see real trends without getting bogged down in tiny, day-to-day changes.

Now, if you're in a fast-paced world like ecommerce with constant new product drops, you might want to check in monthly. The main thing is to be consistent.

Don't just calculate CLV once and file it away. Think of it as a vital sign for your business. Checking it regularly tells you how healthy your customer relationships are and whether your loyalty efforts are actually paying off.

Should I Focus on Historical or Predictive CLV?

The right answer here really depends on how long you've been in business.

If you've been around for a few years and have a good chunk of sales data, historical CLV is your best friend. It’s a reliable, no-fluff number based on what your customers have actually spent. Simple and grounded in reality.

But for newer businesses still finding their footing, predictive CLV is where the real power is. It uses early signals—like how engaged a customer is or what they bought first—to guess their future value. This helps you spot your VIPs much, much sooner.

In a perfect world, you'll blend both. Start with historical CLV to get your bearings, and as you collect more data over time, begin layering in predictive models.

Ready to build a remote business that lasts? At Remotepreneur, we provide the playbooks, founder stories, and step-by-step guides to help you grow. Start your journey with Remotepreneur today.